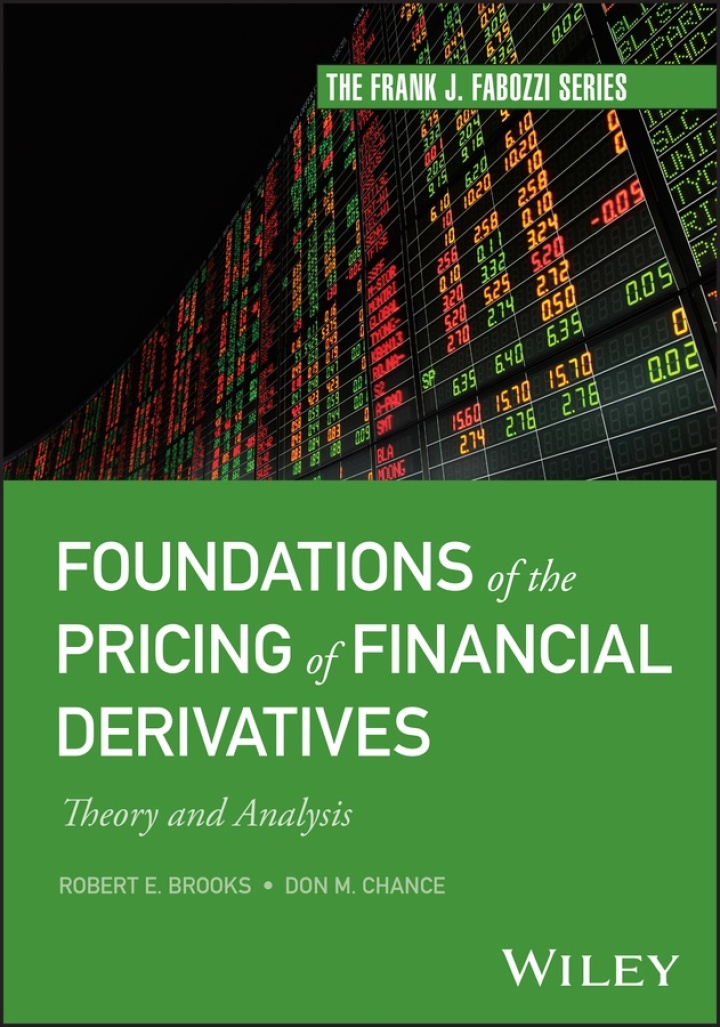

Foundations of the Pricing of Financial Derivatives – 1st Edition

$57.00 Original price was: $57.00.$38.00Current price is: $38.00.

Author: Robert E. Brooks; Don M. Chance

Publisher: John Wiley & Sons P&T

Print ISBN: 9781394179657

Delivery Time: Within 4 hours

Copyright: 2024

500 in stock

- Save up to 60% by choosing our eBook

- High-quality PDF Format

- Lifetime & Offline Access

Foundations of the Pricing of Financial Derivatives 1st Edition

Capture the mechanics behind modern markets with Foundations of the Pricing of Financial Derivatives, 1st Edition by Robert E. Brooks and Don M. Chance. This authoritative guide translates rigorous theory into practical tools for pricing options, futures, swaps and other derivative instruments used in New York, London, Singapore and global financial centers.

Grounded in clear explanations and real-world examples, the book walks readers through core concepts—no-arbitrage arguments, risk-neutral valuation, volatility modelling, hedging strategies and the mathematical foundations that power Black‑Scholes and advanced pricing frameworks. Quantitative techniques are presented with a focus on application, making complex ideas accessible to graduate students, analysts, portfolio managers and trading professionals.

Readers will gain the confidence to model market risk, calibrate pricing models, and interpret market-implied signals across equity, fixed-income and commodity markets. Case studies and illustrative problems bridge theory and practice, showing how pricing insights inform risk management, regulatory reporting and trading decisions across US and international markets.

Whether you’re building a career in quantitative finance, teaching a university course, or maintaining a trading desk, this volume serves as a concise, practical reference that complements your toolkit. Crisp, authoritative and professionally written, this edition positions you to navigate the evolving landscape of financial derivatives with clarity and competence.

Secure your copy of Foundations of the Pricing of Financial Derivatives today and deepen your understanding of derivatives pricing for real-world markets and career impact.

Note: eBooks do not include supplementary materials such as CDs, access codes, etc.

Related Books

Business & Economics

Business & Economics

Business & Economics

Business & Economics

Business & Economics

Business & Economics

Business & Economics