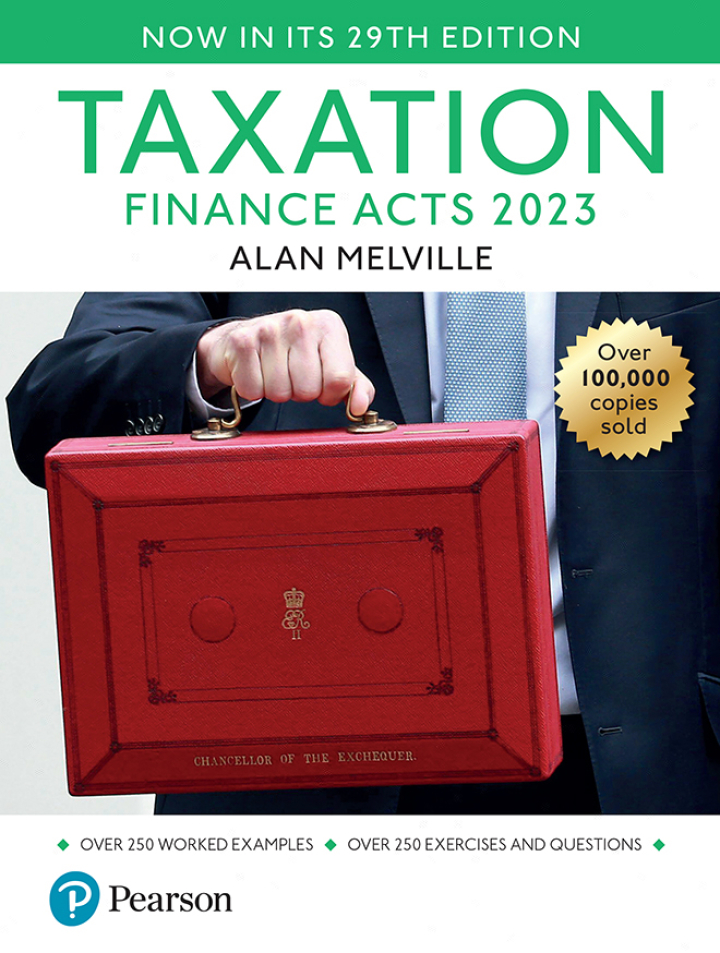

Taxation Finance Acts 2023 – 29th Edition

$60.99 Original price was: $60.99.$38.00Current price is: $38.00.

Author: Alan Melville

Publisher: Pearson (Intl)

Print ISBN: 9781292461083

Delivery Time: Within 4 hours

Copyright: 2023

500 in stock

- Save up to 60% by choosing our eBook

- High-quality PDF Format

- Lifetime & Offline Access

Taxation Finance Acts 2023 29th Edition

Taxation Finance Acts 2023 — 29th Edition by Alan Melville

Cut through complexity with the definitive, up‑to‑date guide to UK tax law. This 29th edition brings together clear explanation and expert commentary on the changes introduced by the Finance Act 2023, turning dense legislation into practical guidance you can use today.

Packed with concise summaries of key provisions, worked examples and annotated extracts, this volume helps you understand how new rules affect income tax, corporation tax, capital gains, VAT and inheritance tax across the United Kingdom. Written in a direct, professional style, it explains technical detail without losing sight of real‑world application — ideal for tax advisers, accountants, solicitors, students and business owners who need dependable interpretation of HMRC policy and statutory changes.

Benefits at a glance:

– Authoritative and current: fully updated to reflect the Finance Act 2023.

– Practical focus: clear examples and application notes that link law to everyday decisions.

– Accessible layout: structured for rapid reference during client work, study or planning.

– Relevant to UK practice: aligns with HMRC guidance and the UK tax framework.

Whether you’re preparing year‑end accounts, advising clients, or studying for professional exams, this edition delivers the clarity and confidence you need to navigate the latest tax landscape. Trust Alan Melville’s long‑standing expertise to keep you informed and compliant.

Order your copy now to ensure your library reflects the most recent legislative changes and practical insights for UK taxation.

Note: eBooks do not include supplementary materials such as CDs, access codes, etc.

Related Books

Business & Economics

Business & Economics

Business & Economics

Business & Economics

Business & Economics

Business & Economics

Business & Economics