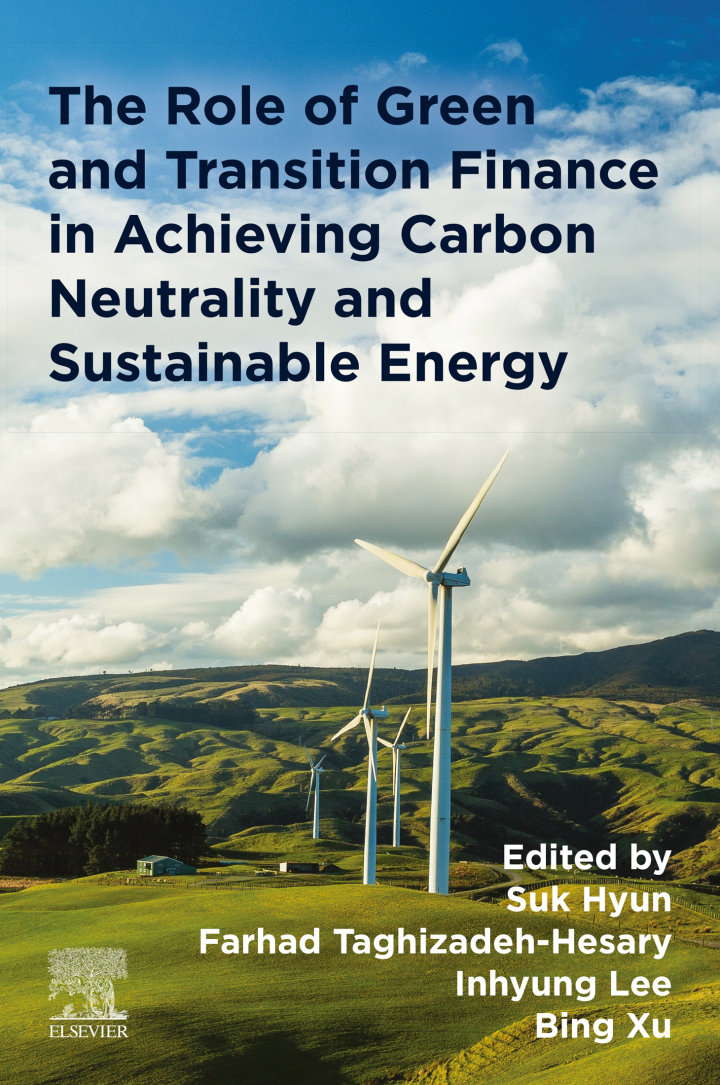

The Role of Green and Transition Finance in Achieving Carbon Neutrality and Sustainable Energy

$185.00 Original price was: $185.00.$38.00Current price is: $38.00.

Author: Suk Hyun, Farzad Taghizadeh-Hesary, Inhyung Lee, Bing Xu

Publisher: Elsevier (S&T)

Print ISBN: 9780443247361

Delivery Time: Within 4 hours

Copyright: 2025

500 in stock

- Save up to 60% by choosing our eBook

- High-quality PDF Format

- Lifetime & Offline Access

The Role of Green and Transition Finance in Achieving Carbon Neutrality and Sustainable Energy

The Role of Green and Transition Finance in Achieving Carbon Neutrality and Sustainable Energy by Suk Hyun, Farzad Taghizadeh-Hesary, Inhyung Lee, and Bing Xu delivers a timely roadmap for investors, policymakers, and energy professionals navigating the shift to low-carbon economies.

Capture the urgency: as governments and corporations set net-zero targets, capital must follow. This authoritative volume explains how green and transition finance instruments—from green bonds to blended public-private mechanisms—can accelerate decarbonization and scale sustainable energy projects across Asia, Europe, and emerging markets.

Dig into practical insights and evidence-based analysis: the authors examine regulatory frameworks, risk management tools, and market-based incentives that make clean energy financing bankable. Case studies illuminate how transition finance supports hard-to-abate sectors while preserving financial stability and social equity. Clear, policy-relevant recommendations make this essential reading for central banks, development agencies, asset managers, and corporate strategists.

Imagine better outcomes: faster deployment of renewables, strengthened climate resilience, and inclusive growth driven by smart capital allocation. Whether you’re structuring climate-aligned portfolios or designing national energy policy, this book equips you with the frameworks and examples needed to turn carbon neutrality goals into investable projects.

Act now to stay ahead of the green finance curve—add this indispensable guide to your professional library and be part of the practical solution shaping sustainable energy and climate finance worldwide.

Note: eBooks do not include supplementary materials such as CDs, access codes, etc.

Related Books

Business & Economics

Business & Economics

Business & Economics

Business & Economics

Business & Economics

Business & Economics

Business & Economics